From digital society to cashless society

The COVID emergency has accelerated the need for increasingly secure and smartphone-friendly economic transactions. The example of the Eni Station+ App.

Italy and mobile payment

Compared to the speed of the digital transformation of other countries, Italy has continued to display contrasting trends, especially in the field of online purchases and e-money. Although Italians leads as regards ownership and use of smartphones, the penetration of e-commerce and mobile payment systems is in fact among the lowest in Europe. This is an evident sign of changes in habits and culture that have so far struggled to impose themselves.

The COVID-19 emergency is significantly altering this scenario, also propelling forward this digitalisation area. The need to minimise contact opportunities, first of all those required when handing over cash or credit cards, has left an open field for applications and technologies suitable to complete money transactions interacting only with your smartphones, accustoming people to do so not only for online but also for in-store or otherwise presential transactions.

While this acceleration is rapid and incisive, it was picking up speed long before the pandemic hit. If, up to 2019, Italy positioned itself in 23rd place in Europe in terms of volume of cashless transactions, 2019 started with a turnaround and a significant increase in the number of Italians using smartphones for in-store payments.

Research carried out by the consultancy firm Kantar for the Innovative Payments Observatory of the Politecnico di Milano, on a sample of two thousand internet users between 18 and 64 years of age, provides interesting data on the matter.

13% of the sample said they paid with the smartphone at the store, but the smartphone seems to have become an all-round reference point for transactional operations: 85% have used it in the last six months for online purchases, favouring it over PCs for convenience and speed of purchase (49%), the option of purchasing outside the home or on the road (37%), and the ability to pay quickly thanks to information already saved on the device (18%).

Moreover, the smartphone is becoming completely akin to an electronic wallet. Indeed, the satisfaction with the mobile payment experience is so positive that 88% of the sample said they will keep on using smartphones for future payments.

Beyond online shopping

The pandemic has induced both end consumers and the business to experiment with new cashless and contactless solutions, or to re-propose existing ones, introducing a change also in daily gestures such as refuelling or paying for in-store purchases. The possibility, arising from the health emergency, of avoiding physical contact in money transactions is emerging as an opportunity that neither consumers nor merchants will easily forego, given the evident advantages in terms of safety and health, but also speed and transparency offered by such an experience.

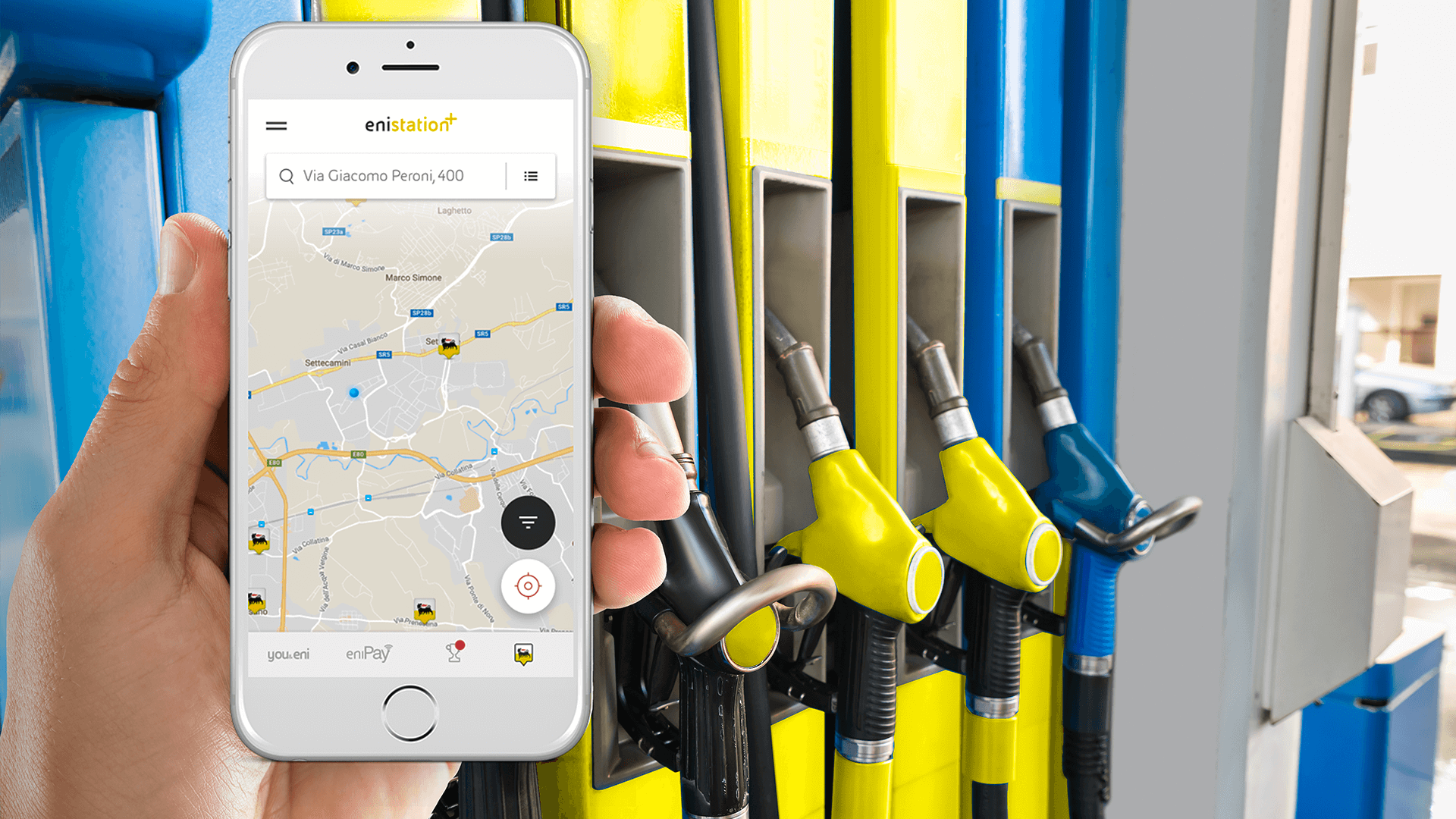

The Eni Station+ app represents an excellent example of an innovative solution, launched long before the pandemic, which fully revealed its usefulness during the emergency. Indeed, one of the main features of this app is the option to refuel at any enabled Eni station, both in self-service and full-service mode, and to pay with a simple click on the application.

To date, it is the only app that guarantees the "safe served" refuelling experience, since it has no physical interactions with personnel or devices (POS) present in the store.

At mashfrog, we have been working for some time on innovative solutions for mobile payment and for the reduction of cash-based transactions. In addition to our ample experience in the development of multi-service mobile applications, we are consolidating the skills in the blockchain and cryptocurrency fields for increasingly secure and cashless payment circuits.

An example for all is Tourist Wallet, a funded project that we are developing together with the University of Tor Vergata and the start-up Foodiestrip for the development and digitalisation of tourism in the Lazio Region. The project consists in the creation of a network of businesses and professionals related to the tourism sector, where tourists will make payments using only a digital purse, i.e. the tourist wallet. The project is based on blockchain technology and offers significant advantages in terms of security, speed and transparency. What is more, it helps create a virtuous circle for the development of the territory and local economies.